How much will the UK Government’s offshore wind target of 40GW by 2030 really cost?

UK offshore wind projects are currently supported through the Contracts for Difference (CfD) support scheme.

To date, offshore wind has been the dominant technology in the ‘Pot 2’ auction for less established technologies (which also includes advanced conversion technologies, AD, biomass CHP, geothermal, remote island wind, tidal stream and wave). Back in October 2017 the UK Government released The Clean Growth Strategy, which stated that there would be a budget of “up to £557 million” (in 2012 prices) for further Pot 2 Contract for Difference auctions.

Then when the CfD Allocation Round 3 (AR3) results were announced in September 2019 it was stated that “for the first time renewables are expected to come online below market prices and without additional subsidy on bills, meaning a better deal for consumers”. This was because the low clearing strike prices in AR3 (compared to the previous Allocation Rounds) were below the Government’s projections for the market references price used in the CfD. Hence the awarded offshore wind CfD contracts were deemed ‘subsidy free’ in the Government’s view. However, if market electricity prices do not match the Government’s expectations what then?

There are multiple factors impacting electricity prices going forward. One of these is the level of deployment of renewables. In March 2019, the Offshore Wind Sector Deal set out an ambition for 30GW of offshore wind in the UK by 2030, subject to costs coming down. However, in December 2019 in the run up to the General Election the Conservative party increased its ambition to 40GW by 2030, this was later reaffirmed in the ’10 Point Plan’ and Energy White Paper announcements of December 2020.

The greater the capacity of offshore wind installed in the UK, the greater the level of price ‘cannibalisation’ for wind farms. An intermittent generator, such as offshore wind, has little control over the periods in which it generates. It generally produces electricity when the resource is available rather than being scheduled to capture a specific price profile. As a result, the average price earned by an intermittent offshore wind generator over a year may significantly diverge from the baseload wholesale price (i.e. the simple average of all hourly prices in a year). In simple terms, the market price is lower on windy days when wind farms generate more. The price earned by the wind generator is referred to as the ‘wind capture’ price. As more wind capacity is deployed capture prices will be lowered for both existing and future wind projects, thereby increasing the difference between the clearing strike prices and intermittent reference prices for all CfD supported wind projects.

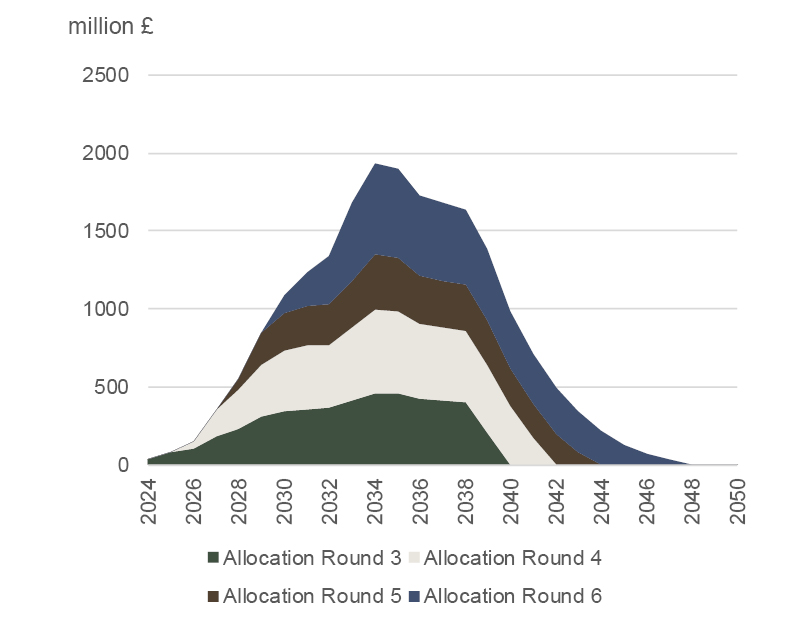

Analysis we have undertaken shows that the current projected cost of supporting 40GW of offshore wind in 2030 under the CfD support mechanism far exceeds the previously published limit of £557 million per year, as offshore wind capture prices are projected to be below the clearing strike prices. Using our latest ‘market-wide’ offshore wind capture price projections, in which the 40GW offshore wind target is not achieved until 2033, the total cost may be as high as £1.1 billion in 2030 (2012 prices), if 40GW of offshore wind is operational the total cost may be as high as £2.4 billion in 2030. The figure below shows the total cost of moving to 40GW by 2033 based on our latest Central scenario projections. The figure also shows the breakdown across the different Allocation Rounds (AR3 to AR6). Our latest strike price assumption range from £38-39/MWh in AR4 to £35-36/MWh in AR6 (2012 prices).

An electricity system with high levels of offshore wind will benefit consumers by lowering electricity prices but it will also lead to higher levels of CfD subsidy to pay generators the difference between the intermittent reference price and clearing strike prices. This raises the question of how much the Government is willing to support offshore wind? Can the CfD scheme adapt to keep costs under control? Can the UK Government justify that the benefits of offshore wind outweigh the costs?

On the other hand, there are factors which may increase electricity prices and offset some of the cannibalisation impact of 40GW of offshore wind deployment, such as an increase in the carbon price. The level of support required may also be impacted by changes to the CfD design for future auctions – the Government has recently issued a call for evidence on this. Finally, can and will all the additional capacity required to achieve the targeted 40GW of offshore wind by 2030 receive CfD support?

In our view, the new target of 40GW of offshore wind by 2030 will require a CfD support budget far in excess of the budget cap announced in 2017. To date there has been no recognition of this by the Government. The assumption is that the £557m budget cap no longer applies, but developers may wish to hear explicit confirmation of this.

For more information, contact Sarah Husband or Ali Lloyd.